Crypto cards are gaining attention as people search for simpler ways to use their digital assets in everyday life. Unlike regular debit or credit cards that link only to a bank account, these cards connect directly to your cryptocurrency balance. This means you can shop online, pay for groceries, or book travel with Bitcoin, Ethereum, or even smaller tokens, while the card provider automatically converts them into local currency.

For many users, the main appeal lies in convenience and flexibility. A crypto card can make it easier to spend trading profits, access funds across borders, and even earn rewards such as cashback in digital coins. Some providers also promote additional perks that make crypto spending feel seamless and modern.

Yet, there are challenges that come with this freedom. Fees, tax reporting, and the risk of sudden market changes can complicate how practical these cards really are. Understanding both sides is essential before deciding if a crypto card suits your financial goals in 2025.

Seamless Spending

One of the biggest advantages of a crypto card is how smoothly it fits into everyday spending. Instead of needing to convert your coins manually before making a purchase, the card does the work for you. This automated process acts as a built-in way to off-ramp crypto into spendable currency at the moment of transaction, eliminating the need for separate exchange accounts or withdrawal steps that can delay access to funds. Whether you are buying coffee, paying for groceries, or booking a service online, the process feels just like using any other payment card.

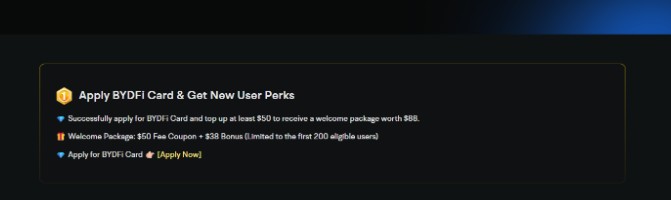

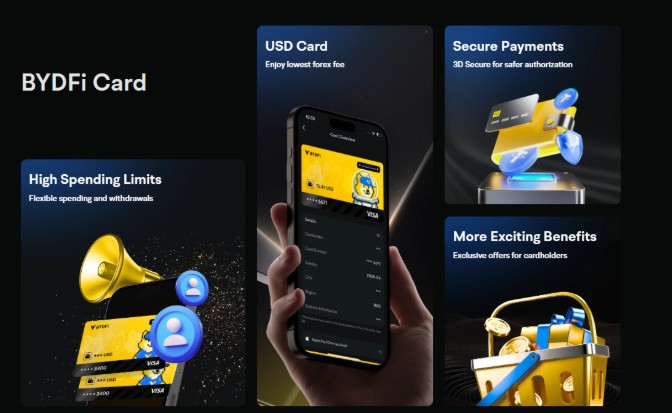

The BYDFi Card takes this convenience even further. It allows users to spend a variety of cryptocurrencies instantly, with automatic conversion into local currency at checkout. This makes it possible to use your digital assets across borders, without having to worry about exchange hassles or carrying multiple cards.

This seamless experience is what makes crypto cards so appealing. They reduce the barrier between crypto holdings and real-world use, letting digital wealth flow naturally into daily life. For many people, that ease of use is a game changer.

Conversion Fees and Hidden Costs

While crypto cards offer convenience, they often come with conversion fees that can add up quickly. Every time a cryptocurrency is converted into local currency at the point of sale, the card provider usually applies a small percentage as a fee. Depending on how frequently you use the card, these costs can reduce the value of your spending power over time.

Some cards may also include other hidden charges, such as monthly maintenance fees, ATM withdrawal fees, or currency conversion margins. These extra costs are not always obvious at first, which can make it harder to track exactly how much you are spending.

Understanding the fee structure before using a crypto card is essential. Being aware of potential charges ensures you can make informed decisions and avoid surprises.

Global Accesibility

Crypto cards are especially useful for people who travel or make purchases internationally. Unlike traditional cards that may have high foreign transaction fees or require multiple accounts, a crypto card allows users to spend digital assets almost anywhere. Payments are processed in local currency, so there is no need to carry multiple currencies or worry about sudden exchange rate changes.

The BYDFi Card integrates seamlessly with a user’s crypto holdings, allowing funds to be converted and spent quickly wherever Visa or Mastercard is accepted. This makes it easy to use digital assets across borders while staying connected to a secure, trusted service.

Global access and flexibility make crypto cards a convenient tool for modern, mobile lifestyles.

Volatility Risks

One challenge of using a crypto card is market volatility. The value of cryptocurrencies can change quickly, meaning the amount you spend today might be worth more or less tomorrow. For everyday purchases, this can make budgeting unpredictable.

Even experienced traders who use platforms like BYDFi need to consider these fluctuations. While BYDFi offers tools such as stop-loss orders and smart money tracking to manage risk during trading, a card linked directly to crypto balances does not protect against sudden price swings.

Volatility risks mean that spending large amounts of crypto without planning can lead to unexpected losses. Understanding how prices move and keeping only a portion of assets on a card can help users manage this challenge effectively.

Conclusion

Crypto cards offer a convenient way to spend digital assets, making shopping, travel, and international payments easier than ever. Rewards, flexibility, and seamless spending are clear benefits, especially when paired with tools like the BYDFi Card. At the same time, users need to be aware of fees, taxes, and the impact of market volatility. By understanding both the advantages and potential risks, individuals can make informed decisions and use crypto cards safely and effectively in 2025.